Cryptocurrency investing refers to the act of buying and holding cryptocurrencies with the goal of generating profits through price appreciation or income from trading or holding various tokens.

Some people invest in cryptocurrencies as a way to diversify their investment portfolio, while others see them as a potential alternative to traditional assets like stocks or real estate.

Cryptocurrencies have experienced significant price volatility in the past, with some coins seeing massive price increases in a short period of time. This has attracted investors who are looking to capitalise on these price movements.

Another reason people invest in cryptocurrencies is the possibility of using them as a store of value. Some cryptocurrencies, like Bitcoin, are seen as a potential hedge against inflation and a way to protect wealth over the long term.

However, it’s important to note that cryptocurrency investing carries significant risks. Cryptocurrencies are highly volatile and their value can fluctuate rapidly. In addition, the cryptocurrency market is still largely unregulated, which means there is a higher risk of fraud or other types of financial misconduct. It’s important to thoroughly research any cryptocurrency investment and to only invest what you can afford to lose.

What to consider before investing into cryptocurrencies in 2023? In this article, we have enlisted some things you must know before investing in cryptocurrencies in 2023.

1.Make sure you do your Research and due diligence

Before investing in cryptocurrencies, it’s important to thoroughly research and understand the project. This involves learning about the various objectives of the project by reading thoroughly the whitepaper which will give you more details on the underlying technology, the business model and team involved in the project as well as other factors that can affect their price like the tokenometrics.

There are several ways to find reliable sources of information about a cryptocurrency project. One option is to follow industry news and analysis from reputable sources, such as coinmarketcap, including other cryptocurrency news sites such as coindesk and cointelegraph.

It’s also a good idea to join online communities and forums related to cryptocurrencies, as these can be a great source of information and insights from other investors and experts.

In addition when evaluating different cryptocurrencies, there are several key factors to consider. These include the cryptocurrency’s market capitalization, trading volume, and history of price movements. It’s also important to understand the cryptocurrency’s technology and use case, as well as the strength and stability of the project’s development team and community.

2. Setting up a cryptocurrency wallet

A cryptocurrency wallet is a digital tool that allows you to store, send, and receive cryptocurrencies. There are several types of wallets available, including hardware wallets, software wallets, and online wallets.

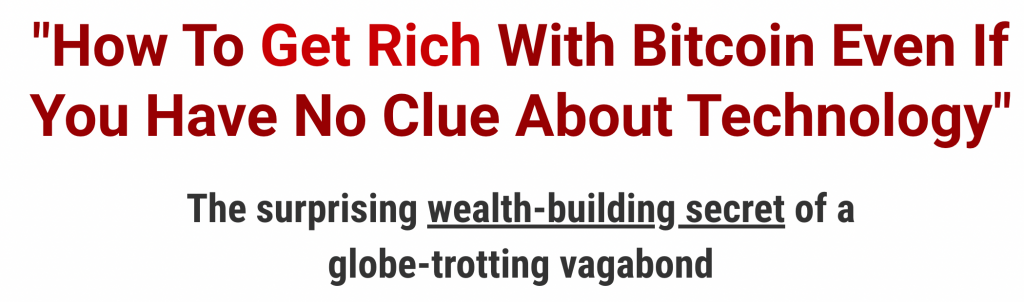

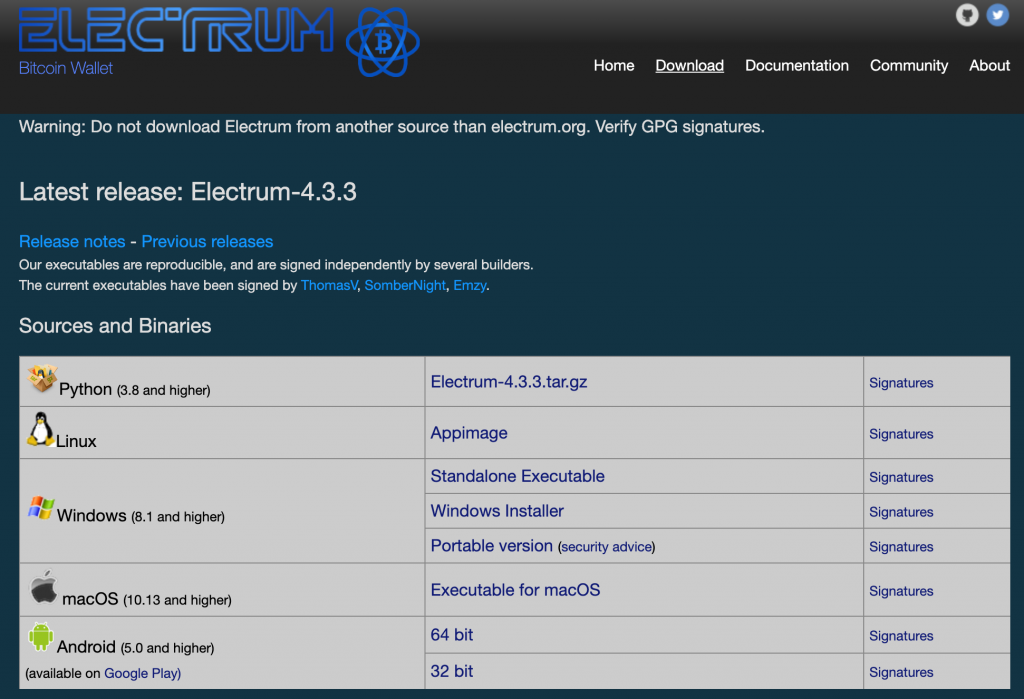

Software wallets are digital applications that you can install on your computer or mobile device. These wallets are generally easier to use and offer a wide range of features, such as the ability to manage multiple cryptocurrencies and interact with decentralized applications (dApps). Some popular software wallets include Trezor, Electrum, and Mycelium.

This wallet allows you to manage and trade a wide range of cryptocurrencies from your computer or mobile device. It is available as a desktop application for Windows, Mac, and Linux, as well as a mobile application for Android and iOS devices.

This wallet allows you to store and manage bitcoin and other cryptocurrencies. It is designed to be lightweight and easy to use, and offers advanced features such as multi-signature support and integration with hardware wallets like Trezor.

This wallet is for Android and iOS devices. It allows you to store and manage bitcoin and other cryptocurrencies. It is known for its advanced security features, such as HD security and offline transaction signing, and also offers integration with hardware wallets like Trezor.

Hardware wallets, on the other hand, are physical devices that store your cryptocurrencies offline. This makes them more secure against online threats like hacking, as your private keys are stored on the device and not on a central server. Hardware wallets are typically more expensive than software wallets, but they offer a higher level of security for long-term storage of large amounts of cryptocurrencies. Some popular hardware wallets include Ledger and Trezor.

This hardware allows you to securely store, manage, and trade a wide range of cryptocurrencies. It is known for its small size and portability, and offers advanced security features such as a secure element chip and support for multiple wallets.

This hardware wallet allows you to securely store your cryptocurrencies offline. It is a physical device that connects to your computer or mobile device via USB and allows you to access your cryptocurrencies using a secure PIN code. The Trezor Model T offers a high level of security and is compatible with a wide range of cryptocurrencies.

Both the Trezor Wallet software and the Trezor Model T hardware wallet are developed and maintained by the same company, Trezor.

When choosing a cryptocurrency wallet, it’s important to consider factors such as security, convenience, and compatibility with your chosen cryptocurrencies. It’s also a good idea to create strong, unique passwords for your wallet and to enable any additional security features that may be available.

It’s important to note that even the most secure wallet can’t protect against all threats. It’s important to regularly back up your wallet and to be aware of the potential risks of using any wallet, such as the risk of losing access to your funds if you forget your password or lose your device. By following best practices and taking a cautious approach, you can use cryptocurrency wallets safely and securely.

3.Invest in cryptocurrency by earning bitcoin through mining, freelancing and other programs:

In addition to investing in bitcoin, there are several other ways to earn bitcoin. Here are some options to consider:

- Bitcoin mining: Bitcoin mining involves using specialised computer hardware to solve complex mathematical problems, which helps to verify transactions on the bitcoin network and earn rewards in the form of bitcoin. Bitcoin mining requires significant upfront investment in hardware and electricity, and is generally more suitable for experienced tech enthusiasts.

- Bitcoin faucets: Bitcoin faucets are websites or apps that pay small amounts of bitcoin in exchange for completing tasks or viewing ads. These tasks may include answering surveys, playing games, or completing offers. Bitcoin faucets are a relatively easy way to earn small amounts of bitcoin, but the payouts are typically very low.

- Bitcoin rewards programs: Some websites or apps offer rewards in the form of bitcoin for completing certain tasks or activities. For example, you might be able to earn bitcoin by watching videos, visiting websites, or completing surveys.

- Bitcoin affiliate marketing: Affiliate marketing involves promoting products or services in exchange for a commission. Some companies offer affiliate programs that pay in bitcoin, allowing you to earn bitcoin by promoting their products or services to your followers or audience.

- Bitcoin freelancing: Freelancing involves providing services in exchange for payment. Some freelancers accept bitcoin as a form of payment, allowing you to earn bitcoin by providing services such as writing, design, or programming.

- Bitcoin microtasks: Microtask platforms allow you to earn bitcoin by completing small tasks or jobs. These tasks may include transcribing audio, labeling images, or moderating content.

- Bitcoin lending: Bitcoin lending involves lending bitcoin to borrowers in exchange for interest. This can be a way to earn passive income in the form of bitcoin, but it also carries a lot of risks.

- Bitcoin staking: Some cryptocurrencies, such as Tezos, allow users to earn rewards for holding and staking their coins on the network. This process, known as proof-of-stake, helps to secure the network and allows users to earn a passive income in the form of new coins.

- Bitcoin airdrops: A bitcoin airdrop is a marketing strategy in which a company or organization distributes free bitcoin to a large number of users. Airdrops are typically offered as a way to promote a new cryptocurrency or to reward users for their support of a project.

4.Choosing a reputable exchange

When buying and selling cryptocurrencies, you’ll need to use a cryptocurrency exchange. There are two main types of exchanges: centralized exchanges and decentralized exchanges.

Centralized exchanges are operated by a single company or organization, which holds users’ funds and facilitates trades between buyers and sellers. Centralized exchanges are generally easier to use and offer a wider range of features, such as margin trading and advanced order types. However, they also carry the risk of centralization, which means that the exchange has control over users’ funds and can potentially freeze or seize accounts.

Decentralized exchanges, on the other hand, are built on blockchain technology and operate without a central authority. This makes them more resistant to censorship and fraud, but they can also be more complex to use and may have limited features compared to centralized exchanges.

When choosing an exchange, it’s important to consider factors such as fees, security, and reputation. Some exchanges charge higher fees for trades or withdrawals, which can eat into your profits. It’s also important to choose an exchange with strong security measures in place, such as two-factor authentication and secure storage of users’ funds. Finally, it’s a good idea to choose an exchange with a good reputation in the community, as this can be an indicator of the exchange’s reliability and trustworthiness.

To evaluate the credibility of an exchange, it’s a good idea to do some research and read reviews and testimonials from other users. You can also check the exchange’s regulatory status and whether it has any licenses or certifications. It’s also a good idea to use a trusted third-party service, such as a cybersecurity firm, to audit the exchange’s security practices. By following these tips, you can choose a reputable and reliable exchange to buy and sell cryptocurrencies.

5.Creating a diversified investment portfolio

Diversification is an important principle in investing, and it’s especially important in the volatile world of cryptocurrencies. By creating a diversified portfolio of cryptocurrencies, you can spread your risk across a variety of different coins and projects, which can help to mitigate the impact of any one coin’s price movements.

There are several ways to create a diversified portfolio of cryptocurrencies. One approach is to invest in a variety of different coins, representing different sectors or use cases. For example, you might include a mix of coins focused on payments, smart contracts, privacy, and other areas.

Another way to diversify is to invest in different types of cryptocurrency assets, such as tokens, coins, and stablecoins. Stablecoins, in particular, can provide a degree of stability to your portfolio, as they are designed to maintain a stable value relative to a fiat currency like the US dollar.

It’s also important to consider the overall size of your portfolio and the percentage of your investment that you allocate to each cryptocurrency. A larger portfolio with a smaller percentage invested in each cryptocurrency can help to reduce the impact of any one coin’s price movements on your overall portfolio value.

However, it’s important to note that diversification does not guarantee a profit or protect against loss. There are always risks associated with investing in cryptocurrencies, and it’s important to carefully evaluate the risks of any investment before proceeding. Investing in a single cryptocurrency, particularly a relatively new or unproven coin, carries a higher level of risk than investing in a diversified portfolio.

6.Managing your investments

Effective management of your cryptocurrency investments can help to maximize your profits and minimize your risk. Here are some tips for managing your investments:

- Set clear investment goals: Before you begin investing in cryptocurrencies, it’s important to set clear investment goals. This can help you to stay focused and make informed decisions about your investments. Some common investment goals might include maximizing returns, minimizing risk, or generating passive income.

- Manage risk: There are several ways to manage risk when investing in cryptocurrencies. One strategy is to use stop-loss orders, which allow you to set a maximum loss level for your investments. If the price of a cryptocurrency falls below your stop-loss level, the order will automatically sell your holdings, limiting your potential losses. Another way to manage risk is to diversify your portfolio, as discussed earlier.

- Use strategic buying and selling: There are several strategies for buying and selling cryptocurrencies to maximize your profits. One strategy is to use dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, rather than investing a lump sum all at once. This can help to smooth out the impact of price fluctuations and reduce the risk of buying at a high price. Another strategy is to use technical analysis, which involves using chart patterns and other indicators to identify potential buying or selling opportunities.

By setting clear investment goals, managing risk, and using strategic buying and selling techniques, you can effectively manage your cryptocurrency investments and maximize your returns. It’s also important to be aware of the tax implications of your investments and to keep accurate records of your trades and profits for tax reporting purposes.

In this guide, we’ve covered the basics of cryptocurrency investing, including how to research and evaluate different coins, set up a secure wallet, and choose a reputable exchange. We’ve also discussed ways to earn bitcoin and strategies for creating a diversified investment portfolio.

It’s important to remember that cryptocurrency investing carries risks and is not suitable for everyone. Prices can fluctuate significantly and there is the possibility of losing all or part of your investment. It’s important to carefully evaluate the risks of any investment and to only invest what you can afford to lose.

Despite the risks, cryptocurrency investing can also be a rewarding opportunity for those who are willing to do their research and take a disciplined approach to managing their investments. By continuing to learn and stay informed about the market, you can make informed decisions and potentially realize significant returns on your investments.

Disclosure: I may receive affiliate compensation for some of the links in this article at no cost to you if you decide to purchase a paid plan. You can read our affiliate disclosure in our privacy policy. This site is not intending to provide financial advice. This is for entertainment only.